Planning for GST

Goods and Services tax (GST) is a tax which should not impose a burden on the entity that is remitting it to the ATO as it should have been collected by that entity from the customer. It can however become an imposition if it is required to be remitted on a sale when you are unsure of the application of GST. Hence it is important to understand when GST is applicable.

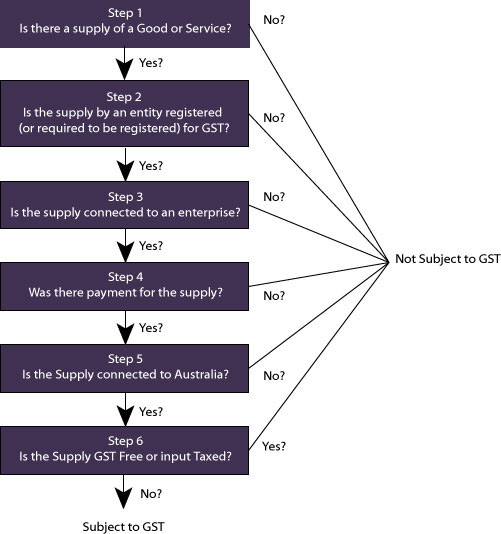

At Bentleys we utilise a 6 step process to determine if a sale is subject to GST, as follows:

Following the above steps and understanding the necessary requirements for each step enables us to determine if a sale is subject to GST, thus providing confidence of the net sales price a vendor is going to receive. In addition to the requirement to collect GST, understanding when GST credits or Input Tax Credits apply can affect the profitability of an enterprise. By not claiming credits that a business is entitled to, the costs of a business are effectively increased.

Some of the areas where specific knowledge is required in respect to Input Tax Credits are:

- Against which type of sale can a credit be claimed i.e. Taxable, GST Free or Input Taxed?

- Tax Invoice requirements to enable a claim

- The ability to claim credits for second hand goods

- Assessing Input Tax Credits when only part business use is involved

- The requirement to reassess the entitlement of Input Tax Credits on an annual basis for a number of years for purchases above certain values

- Limitations to Input Tax Credits with Luxury cars

- Restriction on Input Tax Credits with the margin scheme

Beyond the above the application of GST to a business is largely a cash flow issue, and hence it is important to provide for GST in each sale and purchase in preparing a cash flow forecast for the business. At Bentleys we are able to assist you with all levels of advice in regard to the application of GST and cash flow.